Homeowners Insurance in and around Flint

If walls could talk, Flint, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Being at home is great, but being at home with State Farm's homeowners insurance is the icing on the cake. This great coverage is more than just precautionary in case of damage from ice storm or blizzard. It also can cover you in certain legal cases, such as someone falling in your home and holding you responsible. If you have the right coverage, these costs may be covered.

If walls could talk, Flint, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

Open The Door To The Right Homeowners Insurance For You

With this wonderful coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Ron Gillum Jr would love to help you get the policy information you need, just reach out to them to get started.

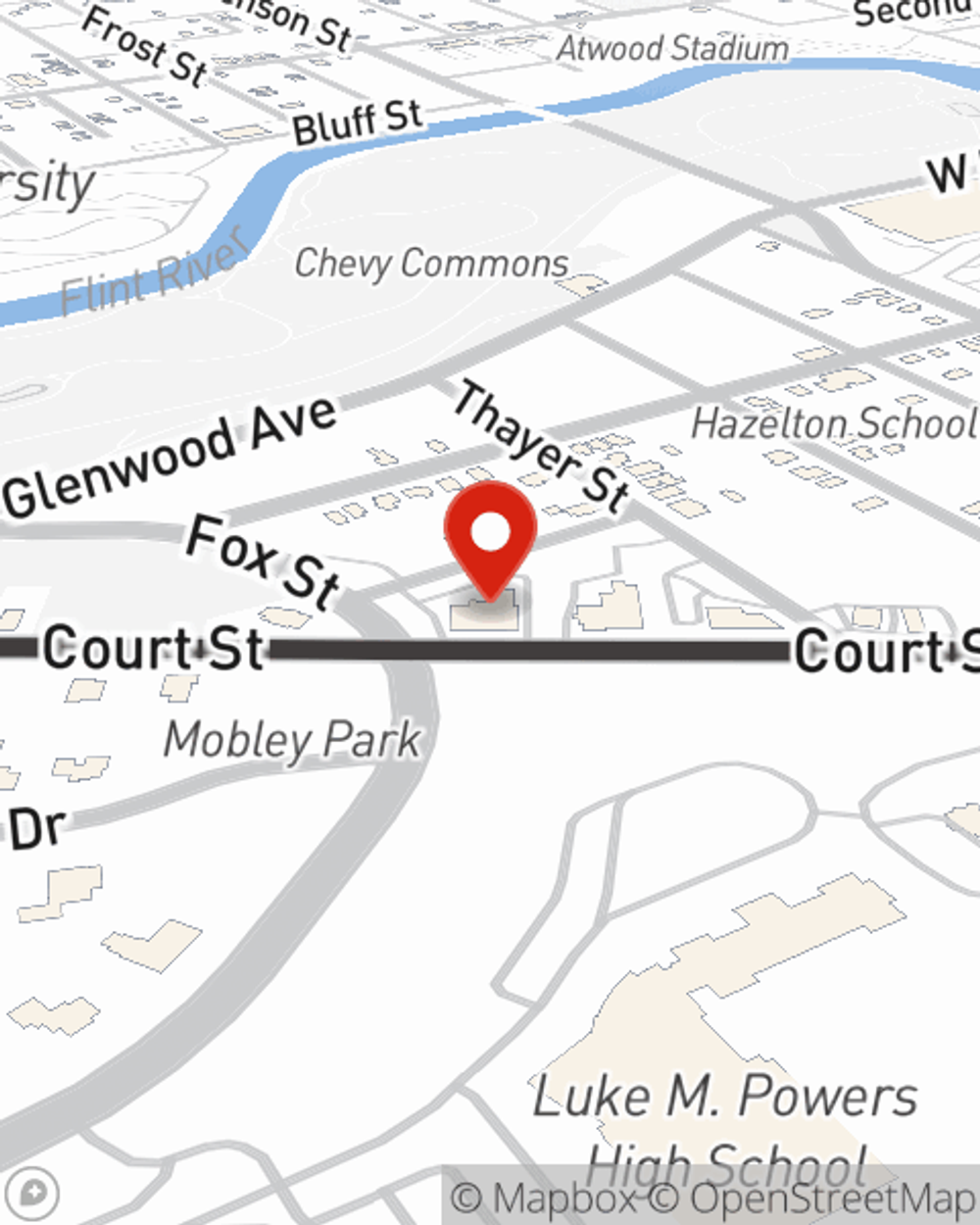

As a leading provider of home insurance in Flint, MI, State Farm strives to keep your belongings protected. Call State Farm agent Ron Gillum Jr today for a free quote on a home policy.

Have More Questions About Homeowners Insurance?

Call Ron at (810) 239-3550 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Ron Gillum Jr

State Farm® Insurance AgentSimple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

Packing tips for moving

Packing tips for moving

Packing smart can help make moving furniture and packing up a house less frustrating. These packing tips can be a great way to get moving.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.